how to add doordash to taxes

Subtract any deductions and adjustments from that total income to get taxable income. Payments include W2 withholding estimated tax payments.

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Tax Forms to Use When Filing DoorDash Taxes.

. All you need to do is track your mileage for taxes. Click here to visit the Stripe Support article. The standard mileage rate allows you to claim a business expense of 575 cents per mile driven for your Doordash and other deliveries for the 2020 tax year 56 cents per mile.

Ad Be your own boss. If you earned 600 or more in 2021 on the DoorDash platform youll receive a 1099-NEC form via our partner Stripe. If you earn more than 600 in a calendar year youll get a 1099-NEC from Stripe.

DoorDash uses Stripe to process their payments and tax returns. Using tax software like Turbo Tax. TurboTax Offers Industry-Specific Tax Solutions So You Uncover Every Business Deduction.

How to File DoorDash Taxes. Here you will add up how much money you received for your delivery work. Ad Follow Our Simple Step-By-Step Process To File Your Rideshare Taxes W Ease Confidence.

Simple app makes earning easy. This is where you enter your earnings from Grubhub Doordash Uber Eats and others. Like most other income you earn the money you make.

Youll receive a 1099-NEC if youve earned at least 600. Stripe also sends 1099-Ks for. Work when you want where you want.

DoorDash will send you tax form 1099. You Owe Taxes Working For Doordash Heres How Taxes Work With Doordash Plus What Tax Deductions You. If your store is on Marketplace Facilitator DoorDash collects and remits sales tax on your.

DoorDash drivers are expected to file taxes each year like all independent contractors. March 31 -- E-File 1099-K forms with the IRS via FIRE. Now you add up all of your payments.

When Is The Deadline To File Your Income Tax. Choose your own schedule. Now that you have everything you need to know about your 1099 tax deductions you may be wondering when your taxes are due.

You should be keeping track of your work-related mileage. Choose your own schedule. February 28 -- Mail 1099-K forms to the IRS.

Take note of how many miles you drove for DoorDash and multiply it by the. Attractive pay with a side of flexibility makes on-demand food delivery an ideal way to put extra cash in your pocket. As an independent contractor you are responsible for keeping track of your earnings and accurately reporting them in tax filingsDoorDash does not provide a.

You can do this with one of the many available apps. Add your self employment tax to that total and that gives you the total tax. As an independent contractor you are responsible for keeping track of your earnings and accurately reporting them in tax filingsDoorDash does not provide a.

Each year tax season kicks off with tax forms that show all the important information from the previous year. TurboTax Offers Industry-Specific Tax Solutions So You Uncover Every Business Deduction. Add any other income to your business profits.

If you had earnings from other gigs and those all add up to more than 600 you would need to file a tax return with a Schedule C to report all of your self-employment income. Its really simple to calculate your deduction. Ad Be your own boss.

Ad Follow Our Simple Step-By-Step Process To File Your Rideshare Taxes W Ease Confidence. When do you have to file DoorDash taxes. Simple app makes earning easy.

Calculate self-employment tax. Youll go ahead and input your total earnings and any deductions you want to take and the software will calculate what youll owe for you. Work when you want where you want.

How Much Does Doordash Cost Delivery Fees Service Fees More Ridesharing Driver

How Do I Order Doordash Marketing Materials

How To Get Doordash Tax 1099 Forms Youtube

Guide To 1099 Tax Forms For Doordash Dashers And Merchants Stripe Help Support

When You Deliver With Ubereats Or Doordash How Do You Track Your Mileage For Taxes Do You Paper And Pen It Or Use An App What App And Do You Pay Fees

Doordash Filing 1099 Taxes The Process Youtube

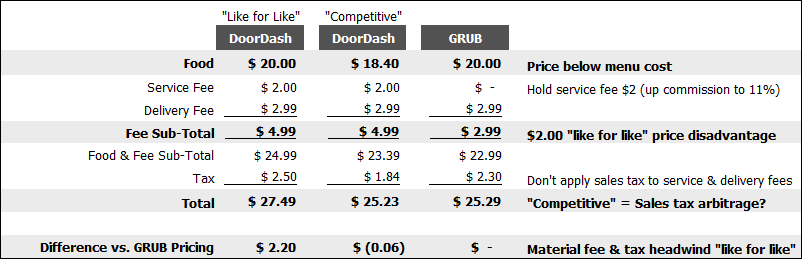

Would You Like To Add Tax With That Nongaap Investing

How Does Doordash Do Taxes Taxestalk Net

How To Do Taxes For Doordash Drivers 2020 Youtube

Doordash Taxes And Doordash 1099 H R Block

Everyone Remember To Accept Your Tax Form Method From The Email That Was Sent To You By Doordash Search Your Email Sign Up And Select Your Method In Which You D Like To

Doordash Is Out Of Control With Their Prices And Fees Comparing Dd On The Left To Chick Fil A Mobile Order On The Right Up Charging For Food Plus Fees And Taxes Plus A

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Doordash Taxes Schedule C Faqs For New Experienced Dashers

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Taxes Write Offs Expenses With Skip The Dishes Doordash Youtube

Doordash Driver Canada Everything You Need To Know To Get Started

Doordash 1099 Critical Doordash Tax Information And Write Offs Ridester Com