2022 tax brackets

Beginning in tax year 2022 each individual income tax bracket will see rate reductions with the top rate lowering from 6 percent to 425 percent well under the new constitutional cap of 475 percent. 2022 Tax Brackets.

Nyc Property Tax Rates For 2022 23 Rosenberg Estis P C

The IRS recently released the new inflation adjusted 2022 tax brackets and rates.

. 2021-2022 Tax Brackets and Federal Income Tax Rates. Northwest Territories Tax Bracket 2022. Looking at the tax rate and tax brackets shown in the tables above for Louisiana we can see that Louisiana collects individual income taxes differently for Single versus Married filing statuses for example.

Individual income taxes are a major source of state government revenue accounting for 36 percent of state tax collections in fiscal year 2020 the latest year for which data are available. Major Provisions of the Updated House Build Back Better Act. We can also see the progressive nature of Ohio state income tax rates from the lowest OH tax rate bracket of 0 to the highest OH tax rate bracket.

Six statesAlaska Illinois Iowa Minnesota New Jersey and Pennsylvanialevy top marginal corporate income tax rates of 9 percent or higher. The Kiddie Tax thresholds are increased to 1150 and 2300. California collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Kansas Tax Brackets 2022 - 2023. Explore updated credits deductions and exemptions including the standard deduction personal exemption Alternative Minimum Tax AMT Earned Income Tax Credit EITC Child Tax Credit CTC capital gains brackets qualified business income deduction 199A and the annual. Rates range from 25 percent in North Carolina to 115 percent in New Jersey.

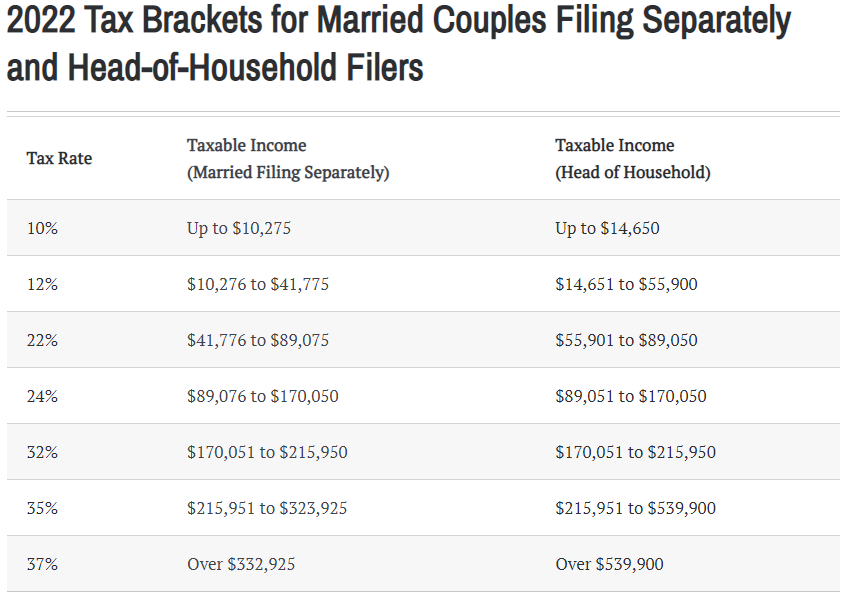

Your tax bracket depends on your taxable income and your filing status. Detailed Illinois state income tax rates and brackets are available on this page. Yukon Tax Brackets 2022.

Provincial Tax Brackets Rates 2022 in addition to federal tax Like we said the province you are living in on December 31 will determine the provincial portion of your income tax. The refundable portion of the Child Tax Credit has increased to 1500. The taxable income rate for single filers earning up to 10275 is 10 percent and for joint married filers is 10 percent tax on income up to 20550.

We can also see the progressive nature of Alabama state income tax rates from the lowest AL tax rate bracket of 2 to the. Forty-four states levy a corporate income tax. Californias maximum marginal income tax rate is the 1st highest in the United States ranking directly.

Because Canada uses a progressive tax system the more money you make the higher the rate of tax you will pay. Looking at the tax rate and tax brackets shown in the tables above for Kansas we can see that Kansas collects individual income taxes differently for Single versus Married filing statuses for example. Looking at the tax rate and tax brackets shown in the tables above for Alabama we can see that Alabama collects individual income taxes differently for Single versus Married filing statuses for example.

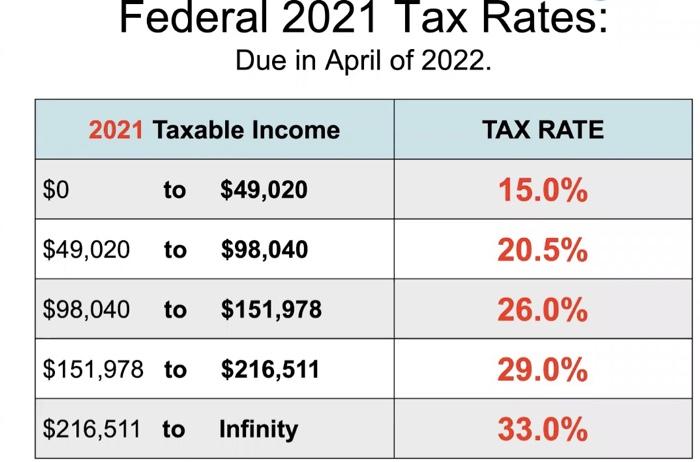

Louisiana Tax Brackets 2022 - 2023. By Nick Zarzycki Fact-Checked by Pat Taylor EA MBA on June 8 2022. There are seven tax brackets for most ordinary income for the 2021 tax year.

Forty-four states levy a corporate income tax. Like the Federal Income Tax Californias income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. So if you are planning skipping town to a province with lower taxes.

We can also see the progressive nature of Kansas state income tax rates from the lowest KS tax rate bracket of 31 to the highest KS. Note that the Tax Foundation is a 501c3 educational nonprofit and cannot answer specific questions about your tax situation or assist in the tax filing process. Start a Free Trial.

Income tax in Canada is based on your taxable income. The changeseffective when you file in 2023are the result of higher. Ontario 2021 tax brackets and rates.

Rates range from 25 percent in North Carolina to 115 percent in New Jersey. Alabama Tax Brackets 2022 - 2023. The new IRS federal tax brackets for 2022 how they work and why they keep changing.

Looking at the tax rate and tax brackets shown in the tables above for Hawaii we can see that Hawaii collects individual income taxes differently for Single versus Married filing statuses for example. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. Compare 2022 state corporate tax rates.

Enacted via the Fiscal Year 2022 Budget Support Act of 2021 the District increased the number of tax brackets from six to seven and altered many of the thresholds. The updated draft legislation would include the following major changes effective January 1 2022 unless otherwise noted. The indexation factor for NWT is 1024 for 2022.

10 12 22 24 32 35 and 37. Georgia On March 22 2021 Georgia enacted HB. We can also see the progressive nature of Louisiana state income tax rates from the lowest LA tax rate bracket of 185 to the.

The states five corporate income tax brackets will be consolidated into three with a reduction in the top rate from 8 to 75 percent. Includes consolidating the states five corporate income tax brackets into three and reducing the top rate from 8 to 75 percent. 593 which increased the standard deduction for single filers from 4600 to 5400 in tax year 2022.

Looking at the tax rate and tax brackets shown in the tables above for Maryland we can see that Maryland collects individual income taxes differently for Single versus Married filing statuses for example. How Much Tax You Owe. Forty-three states levy individual income taxes.

Looking at the tax rate and tax brackets shown in the tables above for Ohio we can see that Ohio collects individual income taxes similarly for Single and Married filing statuses for example. Heres what they are how they work and how they affect you. Your taxable income is your total gross income from all sources less eligible deductions and credits.

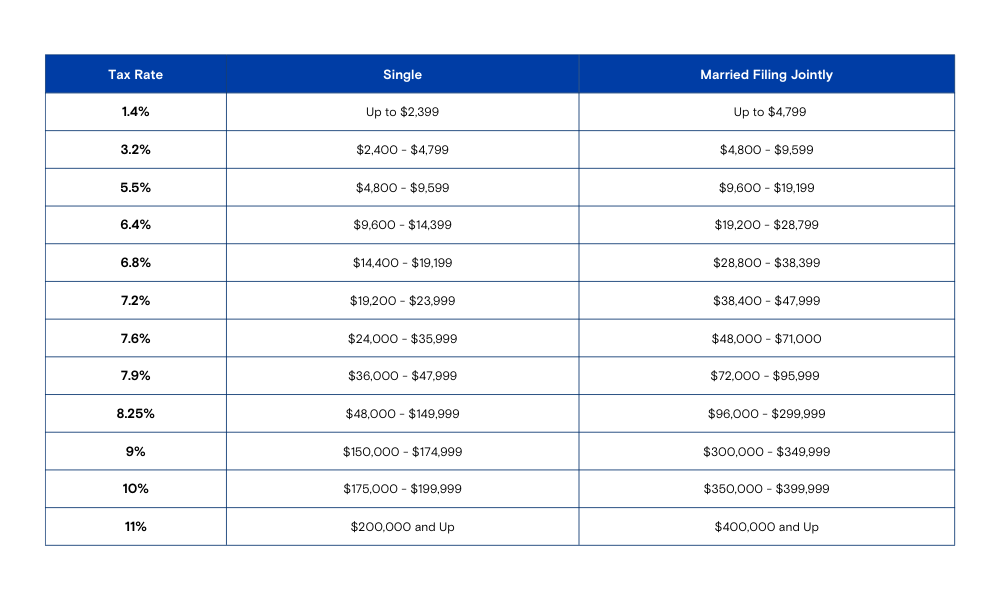

Quebecs indexation factor for 2022 is 10264. We can also see the progressive nature of Hawaii state income tax rates from the lowest HI tax rate bracket of 14 to the highest HI tax. Ohio Tax Brackets 2022 - 2023.

The tax brackets for Ontario for 2021 are. Forty-one tax wage and salary income while New Hampshire exclusively taxes dividend and interest income and Washington. Tax Proposals by the Biden Administration.

We can also see the progressive nature of Maryland state income tax rates from the lowest MD tax rate bracket of 2 to the. 1 888 760 1940. Hawaii Tax Brackets 2022 - 2023.

Written by Sabrina Parys Tina Orem. The Illinois income tax has one tax bracket with a maximum marginal income tax of 495 as of 2022. Nunavut Tax Brackets 2022.

There are seven federal income tax brackets. Federal Income Tax Brackets 2022. Yukons indexation factor for 2022 is 1024.

2022 Federal Income Tax Brackets and Rates. 10 2021 the IRS announced inflation adjustments for 2022 affecting standard deductions tax brackets and more. Maryland Tax Brackets 2022 - 2023.

Understanding Marginal Income Tax Brackets The Wealth Technology Group

Sales Tax Rate Changes For 2022 Taxjar

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

Awp Income Tax Changes Under The September 13th House Ways And Means Proposed Awp

What S My 2022 Tax Bracket Canby Financial Advisors

2022 Tax Updates And A Refresh On How Tax Brackets Work Human Investing

Analyzing Biden S New American Families Plan Tax Proposal

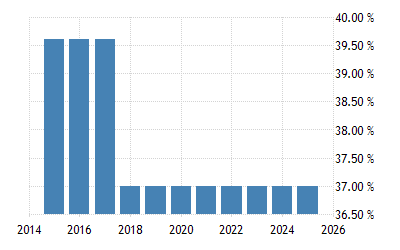

United States Personal Income Tax Rate 2022 Data 2023 Forecast

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Tax Rates Tax Planning Solutions

Key Tax Figures For 2022 Putnam Wealth Management

What Are The Income Tax Brackets For 2022 Vs 2021

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

What S The Racket About Tax Brackets A Look At How Tax Brackets Work Bank Of Hawaii

2022 2023 Tax Brackets Standard Deduction Capital Gains Etc

Irs Announces Inflation Adjustments To 2022 Tax Brackets Foundation National Taxpayers Union

2022 Tax Updates And A Refresh On How Tax Brackets Work Human Investing

2022 Tax Tables Tax Brackets Standard Deductions Credits Ally

Solved Federal 2021 Tax Rates Due In April Of 2022 2021 Chegg Com